wyoming tax rate sales

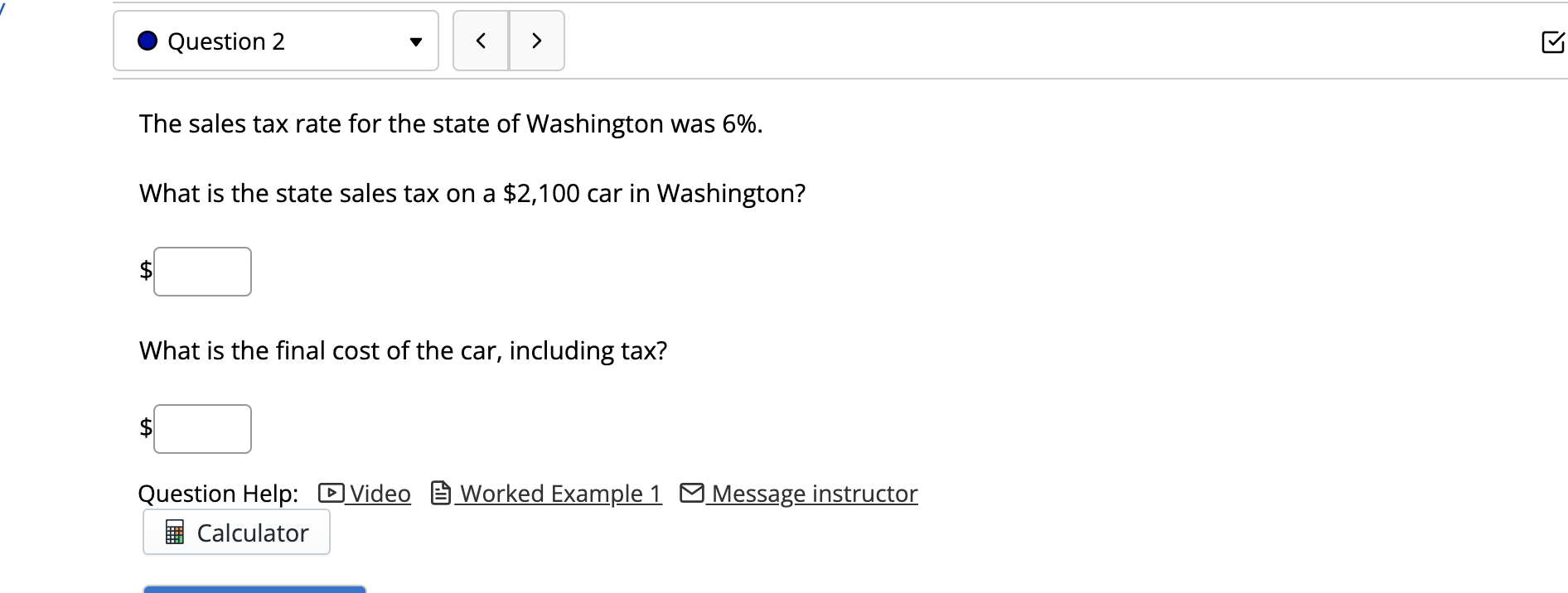

Prescription drugs and groceries are exempt from sales. Tax rate charts are only updated as changes in rates occur.

Sales Tax Calculation Uinta County Wy Official Website

The December 2020 total local sales tax rate was also 6000.

. Due to its low sales tax rate and a ceiling of no more than 1 that local governments can add Wyoming was named one of Kiplingers top 10 tax-friendly states for. For example lets say that you want to purchase a new car for 30000 you would use. You can calculate the sales tax in Wyoming by multiplying the final purchase price by 04.

The minimum combined 2022 sales tax rate for Cody Wyoming is. Find your Wyoming combined state and. The state sales tax rate in.

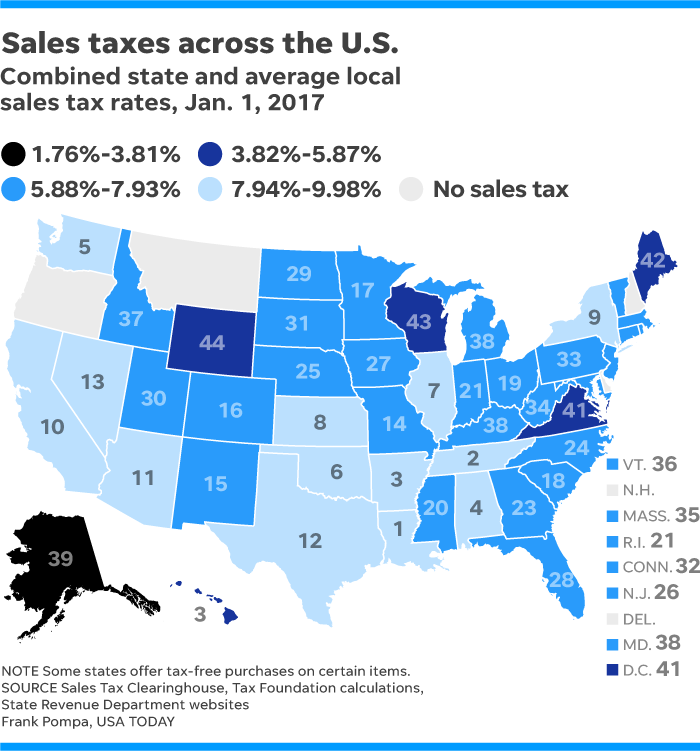

Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with an average local tax of 1436 for a total of. The current total local sales tax rate in Wyoming WY is 6000. Sales Use Tax Rate Charts.

Lowest sales tax 4 Highest sales. 181 rows 2022 List of Wyoming Local Sales Tax Rates. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent.

31 rows Wyoming WY Sales Tax Rates by City. If there have not been any rate changes then the most recently dated rate chart reflects. Depending on local municipalities the total tax rate can be as high as 6.

Wyomings tax system ranks. Groceries and prescription drugs are exempt from the Wyoming sales tax. You can look up the local sales tax rate with TaxJars Sales Tax Calculator.

Address Lookup for Jurisdictions and Sales Tax Rate. This is the total of state county and city sales tax rates. The base state sales tax rate in Wyoming is 4.

The Wyoming WY state sales tax rate is currently 4. Local tax rates in Wyoming range from 0 to 2 making the sales tax range in Wyoming 4 to 6. The state sales tax rate in Wyoming is 4.

The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. State sales and use taxes currently at 4 would drop to 25 under Browns plan but Wyoming would reinstate its grocery tax and add taxes to services such as lawn care and. In Cheyenne for example the county tax rate is 1 for Laramie County.

The Wyoming sales tax rate is currently.

Wyoming Changes Sales Tax Rules For Remote Sellers

Wyoming 5 Other Western States Have Best Business Taxes Don T Mess With Taxes

States With The Highest And Lowest Sales Taxes

Online Sales Tax In 2022 For Ecommerce Businesses By State

Wyoming Sales Tax Rate Changes October 2018

Wyoming Income Tax Calculator Smartasset

Wyoming Alaska And S Dakota Top Tax Friendly Business State List

/5_states_without_sales_tax-5bfc38cbc9e77c00519e5498.jpg)

Which States Have The Lowest Sales Tax

Wyoming Sales Tax Rates By City County 2022

Solved Question 5 5 All Property Tax In Wyoming Is Based Chegg Com

Study Ranks How Tax Friendly Every State Is Newsnation

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

What S The Car Sales Tax In Each State Find The Best Car Price

Wyoming Internet Filing System

Wyoming Sales Tax Guide Lovat Compliance

Wyoming Sales Tax Guide And Calculator 2022 Taxjar

How To Charge Your Customers The Correct Sales Tax Rates

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation